Islamabad, 7 March 2023 (GNP): A global organization of banking governing bodies has commended the progress that has been made by Pakistan in the overall supervision of financial affairs after the country was removed from the Financial Action Task Force’s (FATF) grey list, significantly reducing the risk score of the state.

The Basel AML [anti-money laundering] Index report on Pakistan, which was just released, isn’t expected to have much of an impact on the nation’s economy because of other issues that have “overshadowed” its reform measures.

Also Read: US-Pakistan dialogue on counter-terrorism

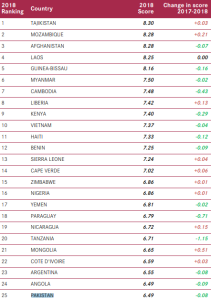

“Pakistan’s total ML/TF [money laundering and terrorism financing] risk score on the Basel AML Index (Public Edition) is 6.16. This places it in the medium-risk category when compared to other worldwide jurisdictions. The Expert Edition’s most recent update, which includes the most recent data and is released every three months, the risk score is slightly low at 6.11,” said the Basel AML Index briefing on Pakistan.

Pakistan increased its score in implementation from 41 percent to 72 percent throughout four follow-up reports from 2018 to 2022. According to the FATF’s current assessment, Pakistan complies with most of its 40 recommendations. Pakistan is only “partially compliant” with R15 (new technologies) and R38 (mutual legal help: freezing and confiscation).

“In keeping with international best practices, Pakistan’s regulatory framework has been tougher over time. While there remain a lot of concerns, AML and issues related have made good progress, according to Topline Securities’ Mohammad Sohail.

Sana Tawfik of Arif Habib Ltd. remarked, “That sounds nice because it recognizes the efforts done for FATF compliance. Yet, I don’t believe it is significant given all the other commotion surrounding our political unrest or our credit rating from international rating organizations. Although the most recent analysis shows that our risk score has decreased slightly, I do not believe that any sector of our economy will benefit.

Also Read: Pakistan hikes policy rate by 300bps, highest in 27 years

Although we have made progress over the years, we still lag behind other countries in the world rankings, according to Haris Ali, an IT specialist who provides corporate organizations with technologically-based FATF-compliant services.